Read Related Articles

News

Poyner Spruill Earns Additional Rankings in the 2025 Edition of Best Law Firms®

November 7, 2024Read More

News

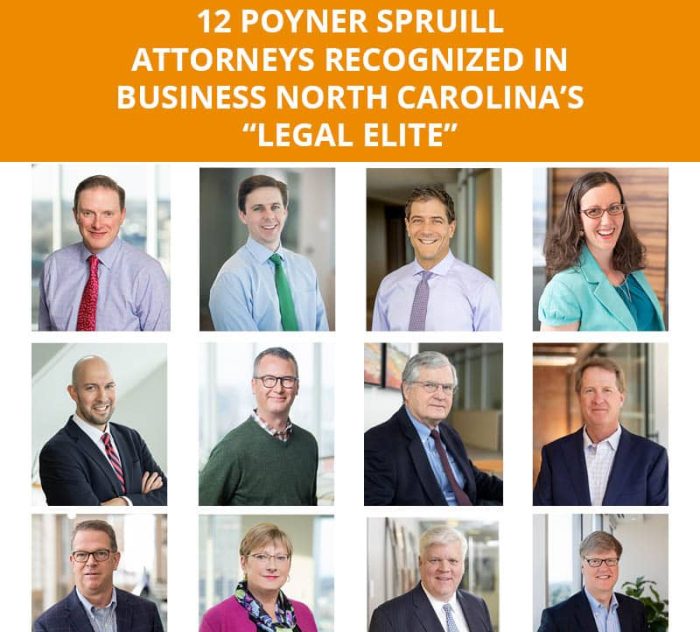

12 Poyner Spruill Attorneys Recognized in Business North Carolina’s “Legal Elite”

January 3, 2024Read More

News

Poyner Spruill Earns 39 “Best Law Firms” Rankings

November 2, 2023Read More

Article

Four Tips to Reduce the Risk of a Tax Audit

By Robin Pipkin | September 20, 2023Read More

News

68 Poyner Spruill Attorneys Named 2024 Best Lawyers

August 17, 2023Read More

News

Poyner Spruill Earns 28 “Best Law Firm” Rankings

November 4, 2021Read More

News

Poyner Spruill LLP Advises Client in $750M Sale

August 26, 2021Read More

Article

New Tax Audit Rules May Warrant Changes to LLC and Partnership Agreements

By Charlie Davis | March 4, 2019Read More

Newsletter

Shorts on Long Term Care May 2018

Read More

Article

Tax Reform Curbs Fringe Benefits

By Hannah Munn | April 4, 2018Read More